2024 Q3 Review

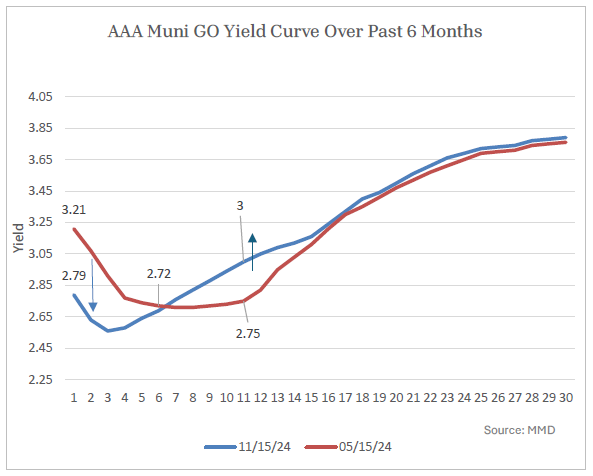

Over the past six months, the AAA Muni General Obligation (GO) yield curve has shown signs of normalization. On September 18, 2024, the Federal Reserve reduced the Target Rate by 50 basis points, followed by an additional 25 basis point cut on November 7. In May, the Muni curve (illustrated below in red) was inverted across maturities ranging from 2 to 16 years. As of today, the inversion has narrowed to the 2–6-year section, as depicted in blue. The recent steepening in the belly of the curve is notable, and with the Federal Reserve maintaining control over the front end of the curve, further rate cuts could accelerate this trend towards normalization and dis-inversion.

10-Year Treasury Yield Rising

The 10-Year Treasury yield has diverged from historical patterns during the Federal Reserve’s current rate-cutting cycle. Notably, this marks the first instance in 30 years (1994) where the 10-Year yield has increased immediately following rate cuts. Over the 55-day span highlighted in the accompanying chart, the Federal Reserve reduced the Fed Funds Rate by 75 basis points, yet the 10-Year Treasury yield climbed by 78 basis points. This unusual response underscores the bond market’s apprehension that premature rate cuts could lead to a premature declaration of victory over inflation.

The Case for Cutting Rates

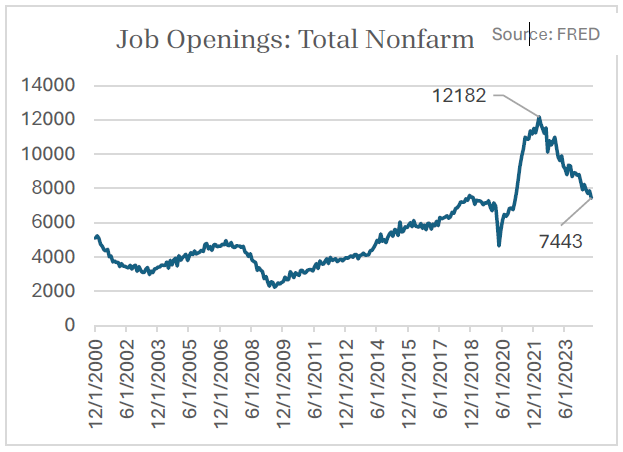

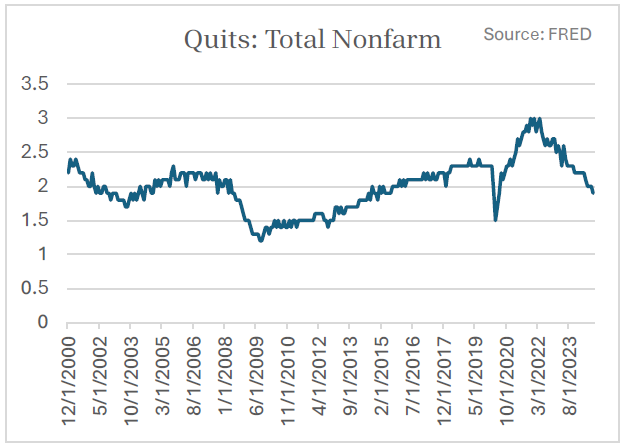

The Federal Reserve’s dual mandate focuses on maximizing employment and maintaining price stability. In our previous newsletter, we discussed the rise in the unemployment rate and the associated risk of a recession if upward momentum continues. The charts above illustrate a notable cooling in the labor market. During 2021-2022, job quit rates reached unprecedented levels as workers pursued new opportunities fueled by COVID stimulus-driven corporate liquidity. This dynamic contributed to rising wages and inflationary pressures. However, since 2022, labor market conditions have moderated significantly, with job openings declining and quit rates returning to levels last seen in 2015 - giving the Fed confidence to begin lowering rates. As the Federal Reserve assesses its dual mandate and aims to land at a neutral policy stance, it now appears more concerned about risks shifting towards the employment side of its objectives.

The State of Pension Funds

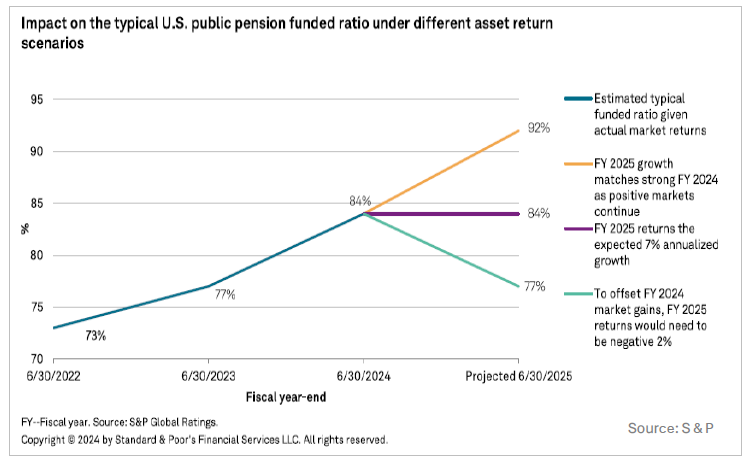

Over recent years, the funded ratios of typical U.S. public pension funds have improved, buoyed by positive market performance. While these funds have yet to approach 100% funding, the upward trend is an encouraging development. However, we remain cautious about investing in large municipalities with significant unfunded pension liabilities, as these obligations could pose a long-term headwind for financial stability and future returns in those regions.

Conclusion

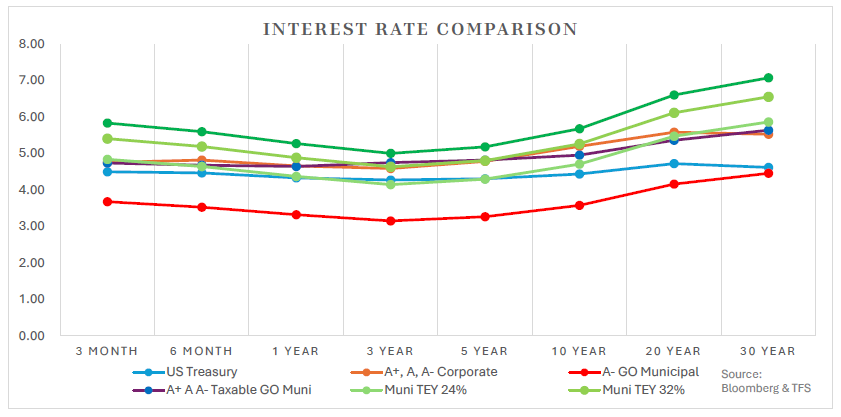

The cutting cycle has begun and with that comes uncertainty. Time will tell if the Fed can pull off a soft landing. We remain concerned about risks to the upside in the unemployment rate but are also concerned cutting rates too much - too quickly - and declaring victory over inflation prematurely. One thing we remain certain about is the attractiveness of Muni Bonds at present. It is not a good time to be in cash as the Fed continues to lower rates. It continues to be a great time to move money out of cash and into higher after-tax yields to lock them up for longer and protect your income stream.