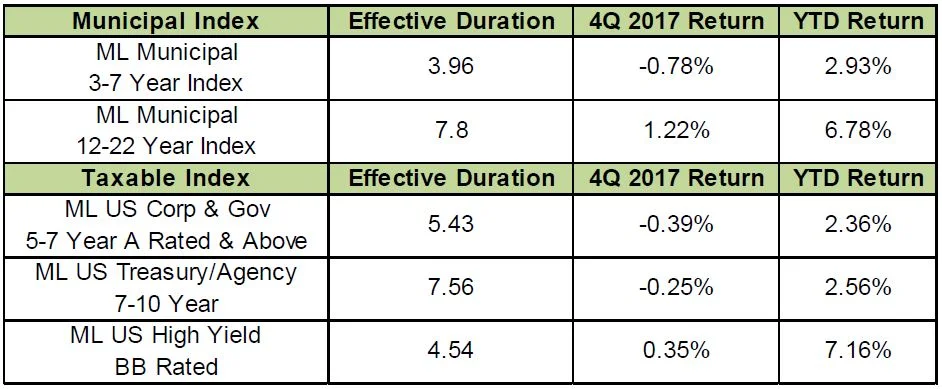

Duration performed well in 2017 as the yield curve flattened. Treasury yields rose from 1.21% to 1.88% on 2‐year notes while yields dropped on 30‐year treasury bonds from 3.04% to end the year at 2.74%. The high yield sector outperformed with equities, followed by long municipals, intermediate municipals, and intermediate government and agency paper.

Return Summary

The following table summarizes the fourth quarter returns for some major Merrill Lynch Bond Indices.

Tax Cuts: Additional Late Cycle Fiscal Stimulus

During the financial crisis of 2008‐2009 the economy could have benefited from a significant shot‐in‐the‐arm from fiscal policy. Instead, the Fed was required to do most of the heavy lifting during this time to stimulate economic growth. They cut the Fed Funds rate to zero and engaged in several aggressive rounds of quantitative easing (QE’s) which resulted in a massive increase in the Fed’s balance sheet, as well as low interest rates for several years. Now more than 9 years after the collapse of Lehman Brothers on September 15, 2008 the Federal government has cut tax rates for corporations and most individuals to get the economy growing faster. We expect these tax cuts to stimulate the economy in the short term which will cause short term rates to rise.

Will the Rate of Inflation Rise?

We expect upward pressure on prices in the near to intermediate

term due to the following factors:

Wage Pressures: The unemployment rate is currently 4.1% which is significantly below the long‐term average of 5.8%. This has led to shortages of workers in some industries such as construction. Employers are also passing out $1,000 bonus payments to their workers because of the tax cuts, and the minimum wage rate is rising in several parts of the U.S.

Housing Prices: The housing glut caused by the financial crisis is over. The number of available homes for sale is at a multi‐year low. This will put upward pressure on housing prices.

Commodity Prices: The U.S. economic recovery has turned into a global recovery. The glut in the supply of oil has been reduced dramatically and prices have been rising. Oil has risen from as low as $27 a barrel to a recent high of over $64 a barrel for West Texas Intermediate (WTI) crude oil. We expect commodity prices to rise due to the global recovery, and higher wealth levels caused by the dramatic rise in equity markets worldwide.

Our research shows inflation tends to be a late‐cycle phenomenon. Since the fiscal stimulus is coming more than 8 years after the beginning of this economic recovery with the above‐mentioned conditions we should see some upward pressure on prices this year. There are, however, factors which may lead to disappointing economic growth in the years ahead.

Economic Headwinds

We do have some concerns about the economic outlook, and we are not as excited as the equity markets about the tax cuts. We see the following headwinds:

Tax Cuts: The Reagan tax cuts were done when the Debt to GDP was about 30%. The current cuts in revenues are coming at a time when Debt to GDP is about 105%‐110%. Debt levels of this magnitude are a serious drag on economic growth. We believe increased borrowing to pay for the tax cuts will likely inhibit economic growth rather than increase it in the long run. Our high levels of debt and sluggish economy won’t be solved by increased borrowing to finance tax cuts.

High Levels of Debt: Virtually all the developed countries are over‐indebted. Studies show Debt to GDP ratios over 90% are a severe drag on economic growth. Monetary and Fiscal policies have been designed to stop the deleveraging process which began during the financial crisis. This means the process of debt liquidation will be drawn out over a much longer period. This will lead to subpar economic growth for many years. Japan is a good example to show borrowing more is not the answer to too much borrowing. They are now suffering from 2 lost decades of economic growth.

Negative Demographics: The U.S. suffers from negative demographic trends which include an aging population, fewer people in the work force, and declining birth rates. These trends are negative for future economic activity and entitlement programs such as Social Security and Medicare. They have also contributed to the problems of funding pension obligations and other post‐ employment benefit programs for municipalities. These problems are well documented. There is no evidence these trends are in the process of changing.

Monetary Policy: The Fed is in the process of increasing the Fed Funds rate. They are talking about raising it 3 more times this year. They are also engaging in Quantitative Tightening (QT) by reducing their balance sheet. Both actions are negative for the economy.

The recent tax cuts have created a sense of euphoria in the equity markets as investors believe the cuts will serve as a driver of economic growth. While we believe they may stimulate growth in the short term, we are concerned about the previously mentioned headwinds for the economy and their drag on economic activity.

The Effect of the Tax Cuts on the Muni Market

The recent tax bill affects the Muni market in several ways. First, refundings of tax‐free issues to generate cost savings will not be allowed. This will restrict the yearly issuance of new Muni deals by as much as 25%. This reduction in the supply of bonds will create a “scarcity” of Munis. Next, the scarcity of Munis will mean tax‐frees should trade at lower ratios compared to the taxable universe of bonds. For example, during the financial crisis long AAA rated 30 year Munis traded at yields of over 110% of long UST bonds with similar maturities. These ratios have already declined to about 90%, and will probably fall to around 85% during the year. This means tax‐free bonds should outperform taxable bonds this year. Finally, the new limits on deducting state and local taxes on taxpayers returns will probably increase the demand for Munis. This is especially true in high tax states.

Infrastructure Financing

We were pleased to see the House version of the tax bill which eliminated the use of private activity bonds did not prevail in the tax bill that was passed. The massive infrastructure needs in our country can be easily financed in the Muni market. These needs have been put on hold since the financial crisis due to budget strains caused by reduced tax revenues and unfunded pension liabilities. One way to finance many of these projects is to utilize private activity bonds and Public Private Partnerships. The participation of the private sector will help reduce the stress for municipalities trying to do it all on their own.

Conclusion

Although we have spent the last year reducing duration by allowing

most of our portfolios to shorten on their own, we still believe we

are in a low interest rate environment for a long period of time due

to the economic headwinds mentioned previously.