The high yield fixed income sector, which is highly correlated with equities, outperformed the Merrill Lynch fixed income indices in the second quarter.

Fixed Income Return Summary

Longer municipals, intermediate corporates, government and treasury indexes, and intermediate municipals had strong returns in the second quarter as well.

The Phillips Curve and the Fed

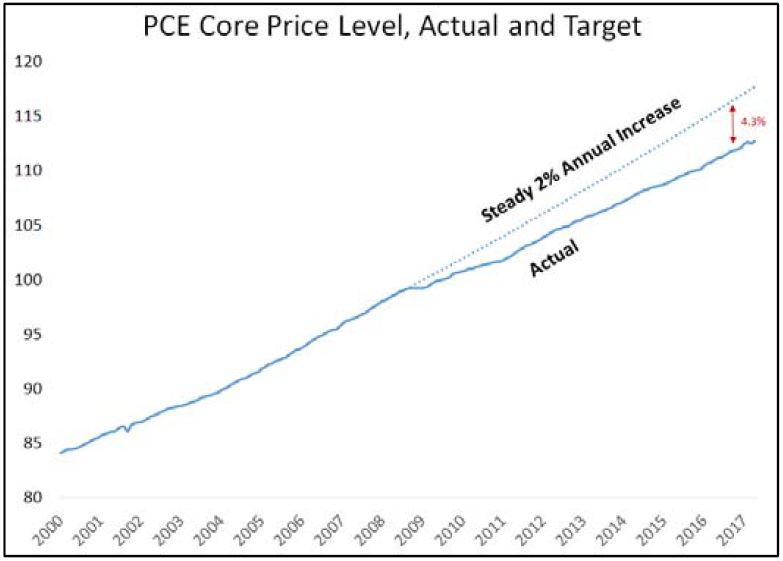

The chart below is from Larry Summers blog. It shows actual inflation as measured by the CPI has grown below the Fed’s 2.0% target since the financial crisis in 2008.

A popular economic principle known as the Phillips curve states there is a tradeoff between unemployment and inflation. Summers makes the case that the Fed is using the Phillips curve principle to raise short term rates as a preemptive strike in case inflation picks up because the unemployment rate has fallen to historically low levels. Summers argues the Fed should not raise rates until inflation is increasing faster than their 2.0% target. We would agree with his analysis and have argued it does not make sense to raise rates when the economy and inflation are both growing below trend. There is no evidence the Phillips curve should be used as a policy tool. The chart below from the Cleveland Fed shows the expected inflation rate is expected to average 1.73% for the next 10 years. If this forecast is correct, the Fed will have had inflation below target for almost 20 years. Since inflation and economic growth are below the Fed’s targets, investors should question why the Fed is raising rates now. They are also talking about another rate increase before the end of the year.

We believe there are two primary reasons for potential further rate increases as the Fed continues to normalize rates. First, the Fed is trying to get rates high enough so that they can use lowering the Fed Funds rate as a policy tool in the event of future economic downturns. It is clear from our experience in the financial crisis the Fed had limited policy options in a zero‐bound interest rate environment. Higher rates would give them more leeway to reduce rates in the future. Second, there are some signs of “irrational exuberance” in equity markets as former Fed chairman Alan Greenspan would say. We have seen the negative effects of financial bubbles bursting in past economic cycles. The Fed may be trying to temper this exuberance now before things end badly. Excessive easing by the Fed for the last ten years has encouraged movement into riskier assets as investors and traders feel they have a “Greenspan/Yellen” put which limits their downside risk in the marketplace. It is possible the Fed is trying to let some air out of the bubble without bursting it. It will be interesting to see how that plays out.

Tax‐Free Rates for the Rest of 2017

It seems the Fed is more interested in reducing speculative activity in the markets than achieving their 2.0% inflation target. The bond market, however, has been focused on slow economic growth and below target inflation. If the Fed continues to worry about the bubble they have created in the equity markets, then it is possible they will continue to pressure rates higher through year end.

Since late last year we have had three 25 bp rate increases by the Fed. One rate increase each in the months of December, March, and June for a total of 75 bp’s to bring the Fed Funds rate up to 1.25%‐ 1.50%. During this time ten year Munis have rallied about 50 bp’s. Last year, bonds rallied into the 4th of July period and then spent the rest of the year giving it all back and more. The chart below shows a comparison between last year and the first half of this year.

If we follow a similar pattern to last year we will have 10‐year AAA rated Munis yielding about 2.75% by the end of the year. That would be up from the current Muni yield of about 2.0%. This would be a rate change of about 75 bp’s over the next six months.

Conclusion

After almost ten years of unprecedented easing of monetary conditions the Fed appears to be ready to slowly remove the punch bowl from the markets and normalize rates. This is shown by recent and projected rate hikes, and increasing talk of beginning to wind down their balance sheet before year end. It will be interesting to see how this works in the face of low inflation and a slowly growing economy.