Long municipal bonds continue to outperform U.S. Treasuries and corporate bonds. Junk bonds, highly correlated with the equity markets, were down for the quarter and lag long municipals by over 6% YTD.

Return Summary

The following table summarizes the third quarter returns for some of the major Merrill Lynch Bond Indices.

Lower Municipal Supply

The total amount of Municipal bonds issued YTD is only $206 billion, a significant decrease from the $230 billion that was issued at this time last year. We believe there are two primary reasons for the supply decline. First, outstanding issues are being refunded at a significantly slower pace. Second, the infrastructure needs of our country have been put on hold as municipalities continue to struggle with a weak economy and lower than expected tax revenues. The graph below compares this year’s issuance with last.

Arizona new issue supply is down 25%, California is down 22%, and taxable municipal issuance is down a whopping 40%. Taxable issuance is now only 7% of the total municipal financings this year. The decline in supply has caused quality spreads to tighten and helped taxable municipals outperform corporate bonds.

Fed Fund Futures Have Built In Higher Future Short‐Term Rates

The Fixed Income markets are building in rate increases for short‐term rates as the Federal Reserve leaves the zero bound and begins to normalize the yield curve. Futures contracts in the chart below indicate market participants expect rate increases to begin in about six months. They predict a funds rate of 0.75% at the end of 2015 and 1.75% at the end of 2016. These increases are all “data dependent.” Sustained economic growth is needed for these increases to come to fruition. We believe the markets have currently priced in a 1% Fed Funds rate and that treasuries are fairly valued at this time.

Our view is that the economy has been on “life support” since the financial crisis in 2008. Even with the support of a zero bound Fed Funds rate and an expansion of the Fed’s balance sheet by $4.0 trillion, the economy has only experienced subpar economic growth. There are limited reasons to expect that the economy will do significantly better once the Fed stops bond purchases and begins to raise the Funds rate. Higher economic growth, especially once stimulus measures are removed and the federal funds rate begins to rise, is not a known event. We continue to expect interest rates will be relatively low for a long period of time.

Eurozone Weakness May Mitigate A Rise In U.S. Rates

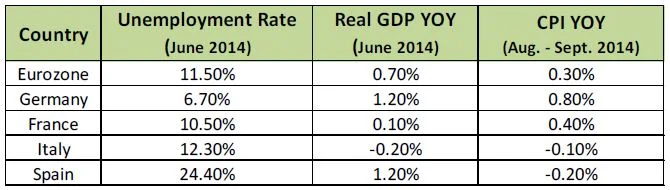

In sharp contrast to the Federal Reserve looking to end its asset purchase program, the European Central Bank continues to add more fuel to the stimulus fire in an attempt to jumpstart the Eurozone’s economy. Plagued by slow growth, low inflation, and high unemployment, the Eurozone has struggled to emerge from the 2008 crisis. The following table summarizes some economic indicators for the region.

The ECB’s current stimulus, coupled with its pledged future support, has helped drive interest rates in the region to all‐time lows. The following table summarizes yields for some European countries vs. the United States.

When compared to international rates, especially those in countries with double digit unemployment and little or no growth, we believe the UST looks particularly attractive. The yield pickup versus other countries should increase demand for UST and help mitigate a potential rise in interest rates once the fed unwinds QE3 and looks to raise the federal funds rate in the future.

Loop’s Pension Funding Review

Loop Capital Markets recently published their Twelfth Annual Pension Fund Review. They reviewed 247 state pension plans and plans for the 25 largest cities. The findings in this document provide some reason for concern about the unfunded pension problems facing the State of Illinois and the City of Chicago. The table below shows the top and bottom 5 states with regard to pension funding levels. Illinois is at the bottom of the list with a funding ratio of only 39%.

While much of the attention to pension liability problems has been focused on Puerto Rico and the City of Detroit, the pension problems in Chicago have gone largely unnoticed. It doesn’t seem that long ago Chicago was a AA rated bond. Today they are rated Baa1 by Moody’s and are on negative credit watch. The City has the lowest funded pension ratio in the country for large cities at 31%. This translates into an unfunded pension liability of $7,397 per capita. This problem will not be easily addressed due to strong laws regarding the sanctity of pensions. We continue to avoid the debt of large cities with pension problems because of the seriousness of the problems they face.

The strength of the economy, inflation expectations, and fed forward guidance will continue to be valuable data points to monitor as we approach the final days of QE3 and a potential rise in the federal funds rate.