Munis outperformed US Treasuries and Corporate bonds last quarter.

Review

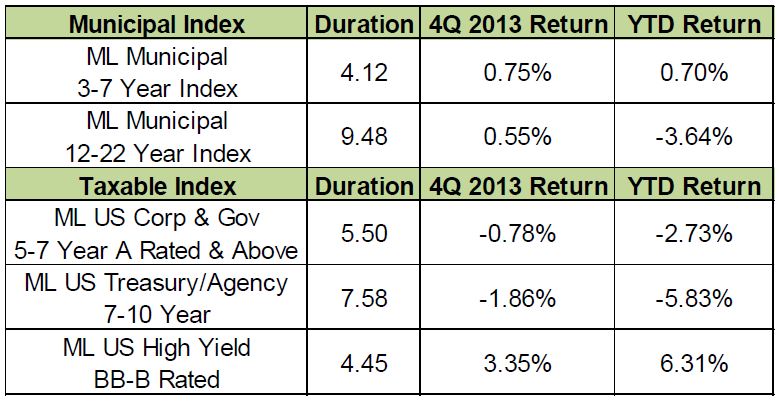

The table below shows returns for the 4th quarter and the year for a variety of Merrill Lynch Bond Indices. Intermediate Tax Free bonds had the only positive return for the year in the High Quality Fixed Income category. Junk bonds, which have a high correlation to equities, were the best performer for the year but lagged equities by a wide margin.

Muni Yield Curve Shift

The chart below shows the shift in the yield curve for Munis during the year. The yield for a 1 year maturity fell slightly, while the yield curve steepened significantly as you go out the curve. Bonds with maturities of 8 years or more saw their yields increase by 1.0%‐1.4% depending on the maturity.

The green bars represent this change in yield for each maturity, and the change is shown on the axis on the right side of the chart. The solid line shows the yield curve at the end of the year and the dashed line at the beginning. The yields for each maturity are shown on the left axis.

Factors Contributing To The Rise In Rates

The primary reason for the rise in rates were repeated comments about the Fed beginning to taper their purchases of UST and Mortgage backed securities. The bond market sold off dramatically when the Fed first mentioned this possibility in June, and by December they took the first step in reducing the amount of their bond purchases from $85 billion a month to $75 billion a month. Yields on 10 year UST finished the year near the highs for the year at 3.0%. The market is discounting further reductions in asset purchases by the Fed in coming months. As the Fed talked about reducing their bond purchases they stressed these reductions would be made if the economy did well and unemployment continued to fall. The economy showed signs of strength through the balance of the year which reinforced investor fears of higher rates.

This led to widespread selling of fixed income mutual funds by investors. As mutual funds experienced redemptions, they were forced to sell securities to meet these liquidations. This caused rates to rise quickly. The chart above shows the decline in Assets Under Management (AUM) due to the decline in market value related to the liquidation which took place in Muni market mutual funds . It is a comparison chart of the last 3 fund liquidation periods: the Lehman crisis, the Meredith Whitney scare, and the Fed’s tapering decision. The recent scare has been more significant and lasted longer than the other periods with Muni mutual fund redemptions continuing for over 30 months. AUM has declined over $88 billion during this last period. This has led to a steeper curve and wider credit spreads as long Muni bond funds and high yield funds have been forced to sell long bonds to meet redemptions.

Fundamentals Are Still Favorable For Bonds

Inflation and the growth of the economy are the 2 primary drivers of interest rates. During the recent rise in rates inflation has not been a problem. In fact, inflation has been below the Fed’s target rate of 2.0% and inflationary expectations remain well anchored. The chart below shows the expected rate of inflation is only 1.75% for the next 10 years. This would suggest a yield on the 10 year UST of about 3.0%. This data is monitored by the Cleveland Fed.

We continue to believe the economy is likely to experience growth below trend for the foreseeable future. The over indebtedness of the economy and negative demographic trends will be drags on economic growth. The Fed has worked hard to minimize and slow down the de‐leveraging process that is necessary to reduce the huge debt overhang in the U.S. This means it will take years for this process to be completed. The tail wind for the economy caused by the baby boomer generation since WWII has now turned into a headwind for economic growth. This is shown most dramatically in the labor force participation rate which has been declining at a very steep rate. The percentage of the population contributing to economic growth is shrinking compared to those who don’t contribute as much to growth in the economy. Finally, the economy has been on life support by the Fed since the financial crisis 6 years ago. During this time the Fed’s balance sheet has exploded as the Fed has attempted to support economic growth by slowing down the deleveraging process and providing incentives for marginal borrowers to borrow and spend. Lending standards have been reduced and artificially low mortgage rates have caused housing prices to rebound nicely. We have not experienced a period of sustained economic growth that was not fostered by Fed intervention since the financial crisis 6 years ago.

Is Economic Growth Possible Without Fed Help?

There has been significant buzz in the press about how strong the economy is and that rates will have to rise in the future as the Fed tapers its purchases of assets. Investors sold bond funds during the recent rise in rates and in anticipation of further rate increases. However, it is important to remember that a rise in rates is not a known event. The recent Fed induced economic strength has been directly related to a rebound in the housing market. However, the chart below shows the housing affordability index is near five year lows.

We continue to be cautious about the prospects for economic growth without Fed assistance. We are surprised that investors are so convinced the economy will do better and rates have to go higher, when there has been no evidence that the economy is able to stand on its own.

While we believe the rise in rates makes the 10 year UST fairly valued at 3.0% we are finding better opportunities elsewhere. We find value in 10 year A‐rated tax free and taxable Municipal securities. The steepness of the curve makes barbell strategies attractive, and we see good opportunities for income oriented portfolios in investment grade bonds.